Medisave

MediSave is a national medical savings scheme that helps individuals set aside part of their income to pay for their personal or approved dependents' hospitalization, day surgeries and selected outpatient treatments.

There are withdrawal limits which have been carefully set to ensure that Singaporeans have sufficient savings in their MediSave Account to pay for their basic healthcare needs.

Using MediSave to pay for family member’s medical bills:

You can use your MediSave account to pay for hospital bills incurred by yourself, your spouse, children, parents, grandparents or siblings. To use MediSave for your grandparents or siblings however, they must be Singapore Citizens or Permanent Residents.

Medisave CANNOT be used for the following:

- Ambulance charge

- Vaccination charge

- ElderShield and CareShield Assessment fee

- Non-treatment related items such as walking stick etc

- In order to utilize your Medisave, you need to submit the Medical Claim Authorisation Form to us.

Medical Claim Authorisation Forms

For approved Medisave claimable expenses, the Medical Claims Authorisation Form (MCAF) can be downloaded from the Ministry of Health’s website.

Please complete the MCAF and submit the duly completed form with the requisite documents to the Business Office.

Which form shall I use to apply for use of Medisave?

The Ministry of Health has introduced two Medical Claims Authorisation Forms (MCAF).

MCAF (Single)

MCAF(S) allows you to use decide and provide limited consent on the utilisation of your MediSave. MCAF(S) allows you to use Medisave at the specific Medisave-accredited institutions only for a single admission.

1. Download and complete the MCAF (S) form.

2. Open the form in Adobe Acrobat Reader (PDF) and fill up the form

3. E-sign the form in PDF

4. E-mail the completed form to SKCH Business Office or OCH Business office. Alternatively you may mail the completed form to:

SKCH

Sengkang Community Hospital, Business Office@Blk 9 Level 4, 1 Anchorvale Street, Singapore 544835

OCH

Outram Community Hospital, Business Office@Level 2, 10 Hospital Boulevard, Singapore 168582

To apply for use of Medisave for a deceased patient, kindly attach a copy of death certificate, a copy of the applicant's NRIC and indicate the applicant's relationship to the patient.

To find out more about filling up your MCAF-S form, you can download the User Guide here [1mb, PDF].

MCAF (Multiple)

MCAF(M) allows you to grant full consent to use your MediSave at all MediSave accredited healthcare institutions.

MCAF(M) provides ease as you simply need to sign once, for life, unless revoked.

1. Submit your MCAF(M) authorization electronically via Health Hub

2. Login with your SingPass

3. Click on 'Give Consent' on the column with the MCAF(M) - Medical Claims Authorisation Form (Multiple)

For consent to be submitted via HealthHub:

- The applicant granting consent has to be aged 21 and above.

- For person below 21 years old, the Parent and/or Legal Guardian will have to make an application on behalf of him/her directly at the participating Public Healthcare Institutions. Please refer to here for a list of participating institutions.

Difference between MCAF (S) and MCAF (M)

| MCAF (S) | MCAF (M) |

| Valid authorization for usage during a fixed period of time | One-time authorization for your current and future treatments |

| MCAF (S) authorization for an inpatient hospitalization is only valid for that particular hospitalisation | Valid for all participating Public Health Institutions. |

Medishield Life

MediShield Life is a basic health insurance plan that protects all Singapore Citizens and Permanent Residents against large hospital bills for life, regardless of age or health condition.

It is administered by the Central Provident Fund (CPF) Board, which helps to pay for large hospital bills and selected costly outpatient treatments, such as dialysis and chemotherapy for cancer.

It is structured so that patients pay less Medisave/cash for large hospital bills. It has affordable premiums that may be fully paid using MediSave.

MediShield Life Coverage

Basic Coverage

MediShield Life coverage is sized for subsidized treatment in public hospitals and pegged at Class B2 wards.

Can I use for MediShield cover A Class ward?

If you choose to stay in an A/B1-type ward or in a private hospital, you are still covered by MediShield Life. However, you will find that your MediShield Life payout will cover only a small proportion of your bill. You would need to draw from MediSave and/or cash to pay the balance.

Difference between MediShield Life and MediShield

MediShield Life replaced MediShield from 01 November 2015 and provides:

- Better protection and higher payout, so that patients pay less from Medisave/out of pocket for large hospital bills

- Protection for all Singaporeans and Permanent Residents, including the very old and those with pre-existing illnesses.

- For more information on MediShield Life, Click here

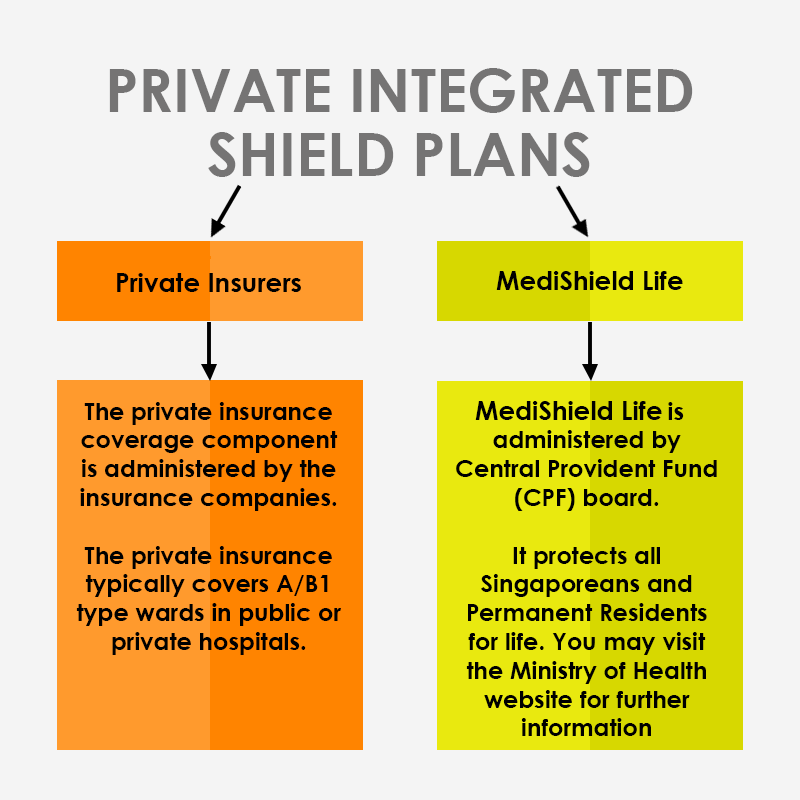

Private Medical Insurance (PMI) - Integrated Shield Plan

Integrated Shield Plan is a scheme which allows CPF members to use their MediSave savings to buy MediSave-approved Integrated Shield Plans for themselves and their dependents. Dependents refer to a member's parents, spouse, children, grandparents, and siblings.

Each insured person can only have one Medisave-approved Integrated Shield Plan paid with Medisave. Frequently Asked Questions on MediShield.